Making Life Less Taxing

Shawcross Consulting

What is a Salary Packaging Arrangement?

A Salary Packaging Arrangement (SPA) is an arrangement where the employee agrees with their employer to contractually change the payment of their salary and wages to include a mix of salary and wages and non-cash benefits. The effect of a SPA is that the employee is taxed on their reduced salary or wages under the marginal income tax rates and the employer is liable to pay Fringe Benefits Tax (FBT), if any, on the benefits provided. Although the employer is legally liable to pay the FBT, a SPA usually includes any FBT payable in the salary packaged amount , i.e. the employee effectively pays any FBT. This ensures that the employer’s total remuneration costs are the same irrespective of how the employee is remunerated.

Why enter into a SPA?

Although most fringe benefits are taxed equivalent to the highest marginal tax rate, there are still some advantages to be obtained from entering into a SPA. The extent of these advantages depend on a number of factors, including:

- The FBT status of the employer - exempt and rebateable employers;

- The types of benefits provided - exempt and concessionally taxed benefits; and

- The marginal rates applicable to the employee’s taxable income.

An effectively structured SPA can reduce the amount of tax paid on an employee’s total remuneration, resulting in greater after tax value to the employee. It can also generate significant on-cost savings for the employer, particularly in relation to payroll tax, super guarantee and Workcover.

There may also be the benefit of the GST input tax credit that is associated with the underlying expenditure. In some cases the savings to the employer could be as much as 25% of the actual expenditure involved in providing the benefit instead of the salary.

Important aspects of an effective SPA

- A SPA is only effective for tax purposes if it is entered into on a prospective basis. This means that an employee can only salary package a future entitlement to salary or wages. In this regard an employee’s entitlement to receive salary or wages usually arises once the services have been performed. It is not necessary for the salary or wages to have been paid for an entitlement to arise. This is particularly relevant where employees are paid bonuses based on past performance. Where a presently existing entitlement is received other than in the form of salary or wages it will still be treated as salary or wages and subject to income tax at the time of payment.

- It should be documented, clearly outlining all elements of the remuneration to be provided and the amounts on which superannuation guarantee, annual leave and long service leave are calculated.

- Must be for a fixed period of time, usually 1 year although shorter time periods are acceptable.

- It should not breach any applicable awards or enterprise agreements.

- It should not contain any benefits that are readily convertible to cash, such as line of credit account payments.

Trends in Salary Packaging

Cultural alignment through your employee benefits

Increasingly employers are looking at ways of providing added value for employees that also reflect their business culture. A well structured employee benefits offering will not only reflect your organisation's culture but will also incorporate all of the non-salary benefits provided to your employees.

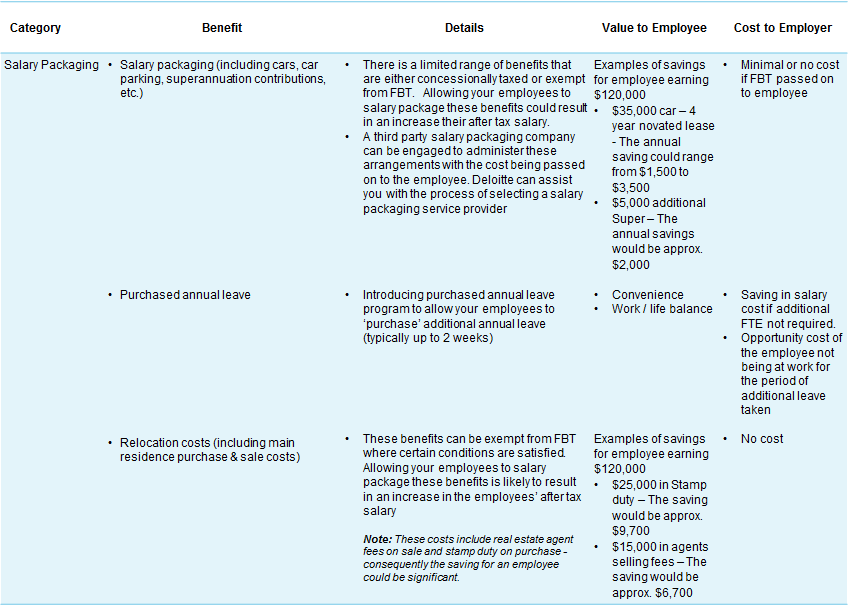

An effective employee benefits offering does not need to cost a lot of money. There are a range of low cost / no cost benefits that can be tailored to meet the specific needs of your business. Some of the key Benefit Categories and the types of benefits that could be provided are summarised below.

Health & Wellness

- Private Health Insurance corporate discounts

- On-site health checks and vaccinations

- Corporate sponsored fitness programs

- Healthy snacks

- Safety awards

Salary Packaging - refer to example below

- Cars

- Superannuation

- Purchased annual leave

- Relocation costs

Community Focused

- Workplace giving

- Sponsoring charity team events - e.g. fun runs

- Charity 'Work Day'

Remote Area Assistance

- Housing assistance

- Assistance with electricity and gas

- Holiday transport

BYO Devices

- Supplier discounts

- Electronic devices - laptops, tablets and mobile phones

Salary Packaging Consulting Services

Shawcross Consulting provides a range of consulting services to assist you in developing an effect salary packaging program for your organisation. Some of these services include:

- Remuneration structure review

- Salary packaging policy and procedural manuals

- Implementation assistance

- Employee information seminars

- Comparative calculations for employees

- Evaluation of salary packaging service providers

- Payroll treatment of package components - pre and post tax

- Novated car leases

- Associate car leases

- Leased luxury cars - impact for employers and employees

- Remote area benefits - housing and utilities

- FIFO transport, including airport car parking

- Expatriate employee packaging

- Exemptions and concessions